Pros & cons of buy-to-let properties

Basics of any buy-to-let strategy assume that the property you bought will be a passive income-generating asset, and in time, when the property prices go up – and they inevitably will – you can sell the property with a profit. Smart property investing, for example by choosing the right type of property financing for your buy-to-let, such as an interest-only mortgage, can result in the first years of your property investment not hurting your wallet too much. While paying only the interests for the first few years of the mortgage, you can enjoy a higher return on property investment. However, as with everything in life, where there are pros, there are also cons to buy-to-let properties.

Pros of buy-to-let

- You’ll earn rental income. Especially if you take out a buy-to-let mortgage, in which you only pay interest, you can enjoy a higher return on your investment. This allows you to use the rental income as your additional revenue stream.

- You are generating capital growth as your property value increases. You can later sell the property to fund for example your children’s education or your own retirement.

- Property is a good choice to diversify your investment portfolio. If the buy-to-let property is chosen wisely, it is considered a safe and long term investment that is tangible and has the potential to fund other investments via strategies such as Equity release

- You become an investor/entrepreneur. With the process of investing in your first buy-to-let, your knowledge will substantially increase! You can choose to do all the research and later decoration of the property yourself, or partner up with an expert, impartial adviser to help you with that, including letting your property out.

Cons of buy-to-let

- If you successfully rent or even sell your property, your tax bill will be higher than it once was. Even if you decide to keep the property and live in it, it will be part of your Estate, subject to high UK Inheritance Taxes. If you decide to sell it, it will be subject to Capital Gains Tax. However, you only pay taxes on profits, so even if you do have a tax liability it means that the investment has worked for you, and you have made money.

There are also ways of reducing taxes using certain tax-efficient structures: Did you know that by putting property in a (Hong Kong) Registered Pension Trust, you no longer have to pay Capital Gains Tax if you decide to sell it, and even reduce the 40% IHT bill if you decide to keep the property? - If the property is unoccupied, you may not generate your rental income – you may still have mortgage costs to pay too.

- There are many costs related to owning and renting a buy-to-let property. You’ll need to factor in the costs of stamp duty, insurance and any costs related to maintenance and these may offset initial gains.

Buy-to-let properties in city centres vs in the commuter belts

Now that we know the pros and cons of buy-to-let properties, it’s important to distinguish between developments bought in the city centres which are more expensive to buy, and properties in so-called commuter belts, which are cheaper to acquire – and may provide higher yields.

Capital appreciation assets – these are properties in the large cities or in city centres where you can historically expect the highest capital appreciation of the asset and hope to sell in a number of years for a profit, while still enjoying the rental income from it. Excellent examples of properties like this are located in London, or in general, closer to city centres. While the rental yield will still be positive, it may be lower compared to specific properties built for rent in mind (such for students).

High-yielding assets – these are properties that are usually not located in the city centres, however, because of the lower initial costs to buy, and excellent commute to the city centre, the rental yield can be proportionally higher. For example, our Birmingham Commuter Belt property price starts from £109,000, and the developer estimates net yields up to 6.47% for long let, and 8.5% short let. To compare, UK medium net yield is approximately 3-4%.

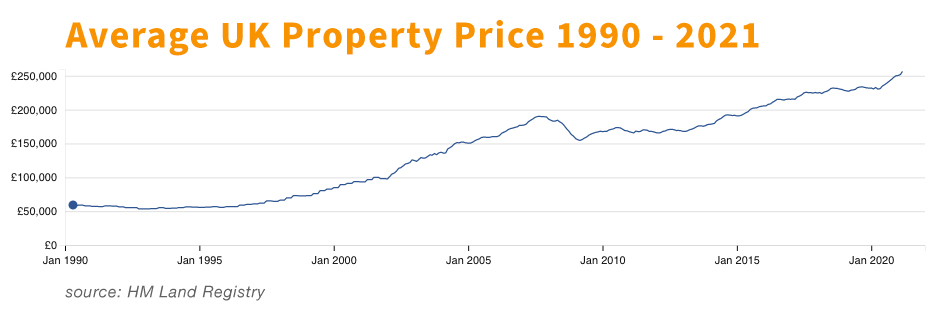

House prices tend to go up

However, even though we distinguish here between capital appreciation and high-yielding assets, they are both going to appreciate in value, as property historically does. In fact, many people use buy-to-let properties as a retirement income, or retirement investment capital exactly because they know that the property will at least be a hedge against inflation. Especially when we look at the UK house prices we can see that historically, even during the Covid-19 pandemic, property prices are steadily increasing.

Do the pros outweigh the cons of buy-to-let properties?

As with any investment, there are benefits, and disadvantages of them and hopefully the above has helped to illustrate these. It is no coincidence that property tends to be one of the biggest assets of investors portfolios and this is simply because it works well. It has a lot of upsides, and if purchased for the long run, and in good locations invariably makes money. With the power of leverage through mortgages, you control a larger asset with your deposit, whilst debt costs are covered through rental making in our opinion buy to let properties one of the best asset classes for long term capital appreciation and income. If you are interested in learning more about buy-to-let properties, please get in touch with experts from Lifestyle Property International.