Is property safer than stocks?

August 2021. The Covid-19 pandemic has now been with us for 18 months. During that time, we have all seen the effects both on personal lives and the economic situation: many businesses have closed, workers have been furloughed, and with the latest Delta variant spreading, it will be sometime before normality returns. Many people have been reluctant to invest because of fear of the unknown and the global economy’s unprecedented situation. So, should we refrain from taking risks until the end of the pandemic, whenever that may be, or take advantage of the present conditions to make sure our money is working for us during this time? Investment property and stock markets are both often viewed as a safe investment strategy in the long term, but “Is property safer than stocks?”

Stock Markets during the Covid–19 Pandemic

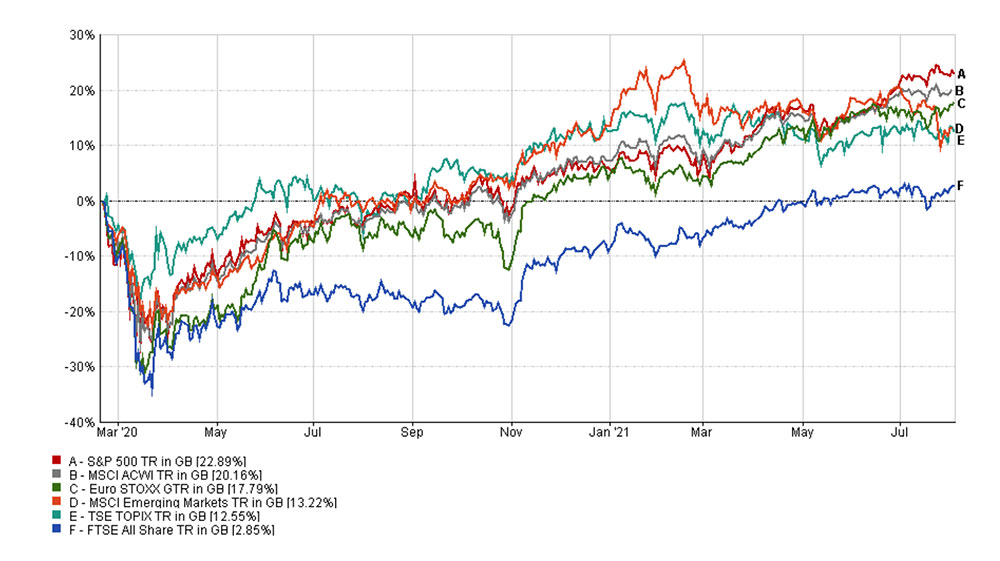

First, let’s look at the stock market and what has happened during the last 18 months to compare property investment in equities. The following graphs illustrate how the markets and property have performed during the pandemic so far.

One thing to note immediately is that the volatility shown by the traditional major market indexes is significant, around -35% for the FTSE 100 in March-April 2020. However, the FTSE 18 months later is still -4.6% below the pre-pandemic level.

Other global indexes have performed better than the UK, which is still in a period of adjustment following Brexit, but were still subject to 20 to 25% falls in that period.

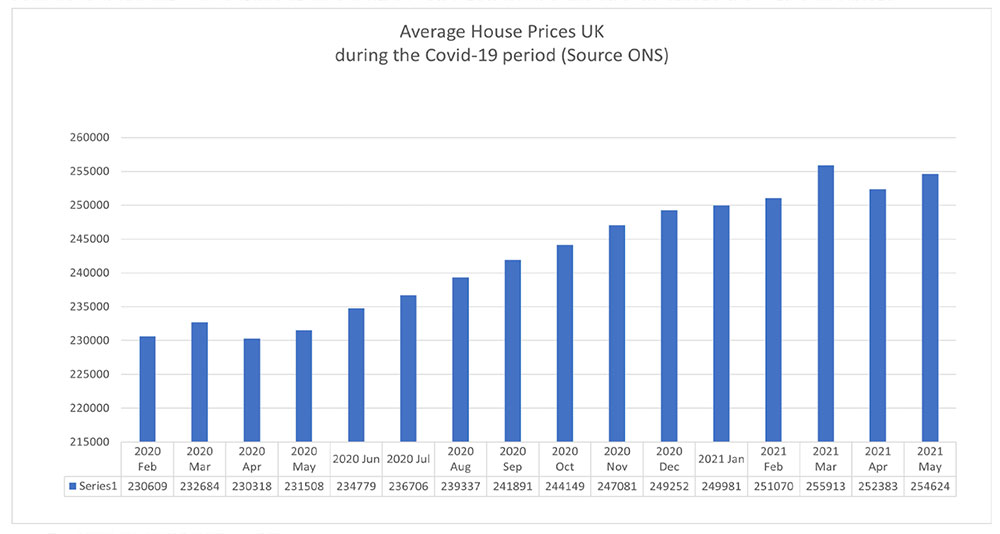

UK property prices during the Covid-19 Pandemic

By comparison, the UK property market has shown much more resilience and less volatility and, in fact, has seen a steady growth of more than 10% with only an initial fall in prices of around 1% at the start of the present crisis. Will this continue, and what are the influencing factors going forward?

UK house prices have been supported by chancellor Rishi Sunak’s actions to reduce stamp duty rates during the pandemic. Under the incentive scheme, the first 500,000 pounds of any UK property purchase in England or Northern Ireland were exempt from stamp duty tax (SDLT) until the end of June 2021. A £250,000 allowance is now running until the end of September, but from the 1st October 2021, the SDLT thresholds will revert to the previous level before 8th July 2020.

For advice on SDLT refunds and what you can expect to pay, speak to one of our experts: https://www.lfsproperty.com/contact-us/

Russell Galley, Halifax managing director, said he expected the market to settle after the recent buying surge, driven by the tax incentive. Still, a shortage of homes on the market was likely to support prices. Galley said the recovery in the economy from its coronavirus shock and higher confidence among consumers suggested annual price growth, while slowing, would remain “well into positive territory by the end of the year.”

The factors supporting UK house price growth

Shortage of properties

As a point of history, social housing fell from nearly 6.5 million units in 1979 to roughly 2 million units in 2017 as council houses were sold as a matter of policy under the Thatcher government. Subsequently, due to policy and a lack of funding, public bodies have abandoned large scale housing construction projects, and private contractors have not filled the gap.

Population growth

The decline in house building has taken place simultaneously as the UK has undergone significant growth in population. Simply, there just aren’t enough homes for those who need them. According to ONS, based on 2018 estimates, from the year ending mid-2025 onwards, the average annual net international migration to the UK is forecast at plus 190,000. It is forecast to account for 79% of the projected UK population growth over the ten years between 2018-2028.

Materials cost inflation

Inflation of building material costs & labour have escalated during the recent stage of the Covid pandemic as supply chain problems, and an increase in demand following the ending of lockdowns has also added to house price inflation. This has worked to the advantage of some developers who are now holding back on the release of new projects in the expectation of higher prices later.

Current price trends in the UK Property Market

The Stamp Duty holiday, which finishes on 30th September, and the easing of lockdown conditions have been the key drivers of the 10% increase on average for UK property during the last 12 months. However, this is expected to slow in the remaining part of 2021, with forecasts of 4% growth by Savills and 5% by Knight Frank for the entire year. Savills also predict housing transactions will hit 1.4 million units this year, 200,000 above the yearly average and also said that investment into the private rental sector in Manchester, Birmingham and Leeds combined exceeded £1bn in 2020, from £361m in 2018, a further indication of the confidence in markets outside London.

So, is property safer than stocks?

The high volatilty of the stock market, clearly illustrated during the Covid-19 period, compared with that of the UK properties, gives confidence in the stability and long-term growth potential of the UK buy-to-let market. After the sharp increase in prices during the last year, there will be a stabilisation process during the remaining part of 2021. Still, history clearly shows that UK property investment provides both stable income and much lower volatility than stocks for the long term. Unlike stocks, your property is a bricks and mortar investment, and even if the overall value depreciates, you’ll still be left with a physical asset. Real estate is simply a much safer option for those willing to invest.

For help and advice to find the ideal property for you, speak to a Lifestyle Property International consultant today!