What is the best city in the UK to invest in property?

Deciding which is the best city in the UK to invest in the property market is a challenge; however, Lifestyle Property International decided to put it into context for you with all the data available. For investors who want to focus on major cities, the information is available in several formats depending on the criteria selected, so let’s start by looking at the areas that are key to making your property investment decision:

- Property prices – is the area expected to see a property price increase?

- Rental Yields – how much rental yield can you expect to get as your property investment return?

- Location & Affordability – which areas of the UK are the most affordable right now?

- Factors outside your control – which government regulations and developments can influence the property market significantly?

- Our winner – The Best Property Investment City in the UK – why we think Manchester ticks all the boxes to gain that title.

The best city in the UK to invest in property by:

Property Prices

Over time, the growth in property prices is a significant factor in the returns that you will make on your investment. Should you take a long-term view and look at the increase over, say, the last 5-10 years, or is the latest data during the Covid-19 pandemic more relevant? Also, what are the demographic trends and other factors which will drive property prices in the future? Consider regeneration, transport links, job opportunities and those dictated by the government, such as environmental policy, stamp duty (SDLT) on purchases and capital gains tax.

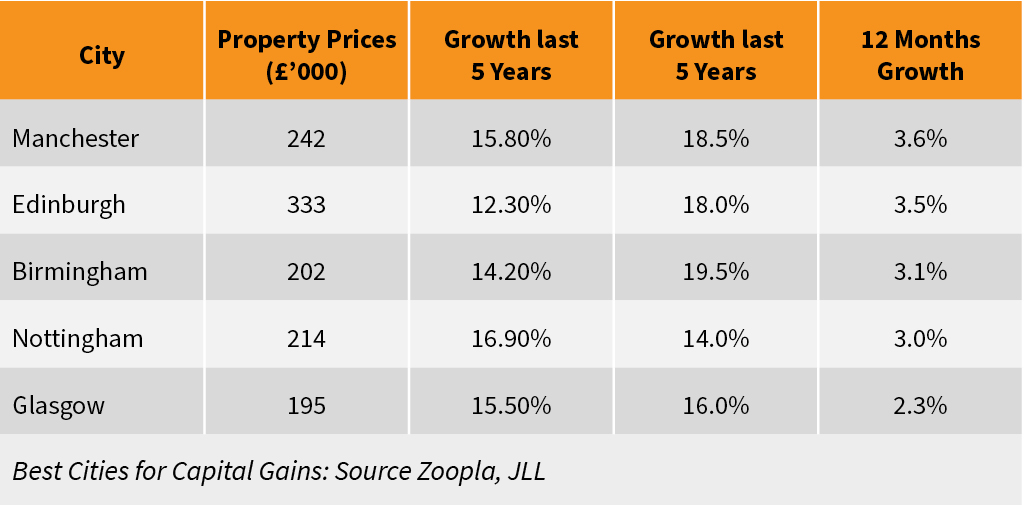

Looking at the current property prices data, Manchester tops the list for Year on Year (YOY) growth as well as in the past five years. In addition, Manchester is forecast to be the number one performer over the next five years. All the 5 top cities have shown excellent investment returns during the past and are expected to continue this trend.

Rental Yields

In the table below, you can see the past 1 and 5-year average house price and rental yields growth and the forecast for the next 5 years for these cities.

Looking to the future, all these cities are forecast to show double-digit yield growth, with Newcastle being the winner based on current yields and Manchester the best over the next five years. However, bear in mind that these are forecasts only, based on existing data and not a certain outcome.

Location & Affordability

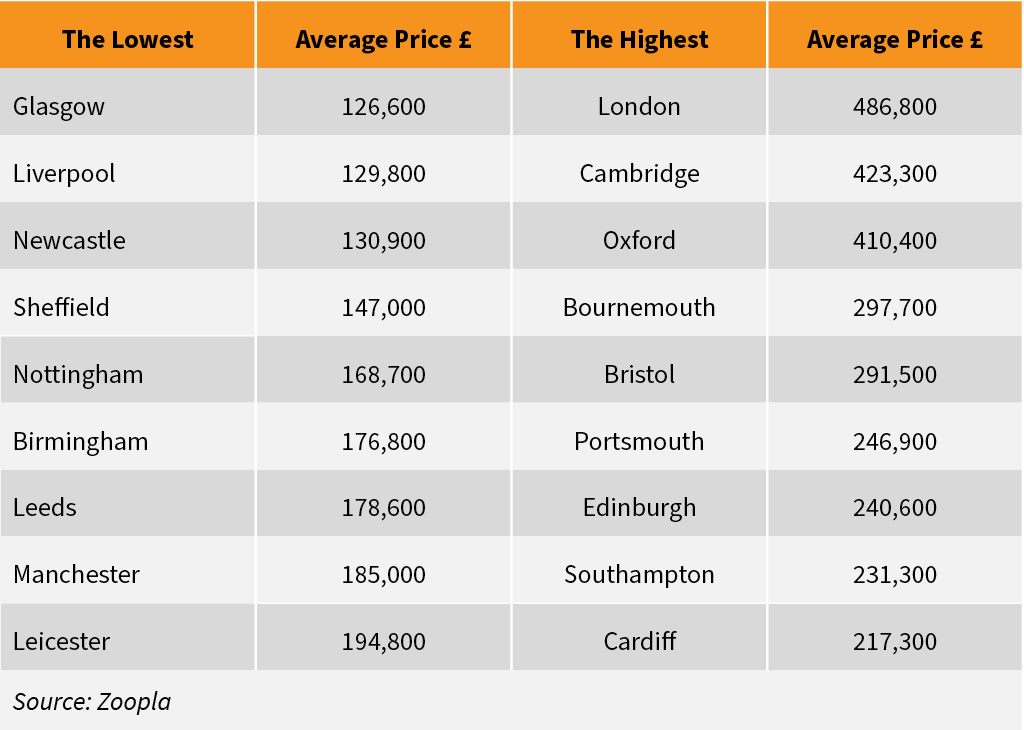

It is easy to see why the demand for property is strongest in the most affordable areas of the UK, boosting capital growth. Meanwhile, London’s popularity has waned during the Covid-19 period, with prices that have been almost static (+0.3%) over the last 12 months, according to Hometrack. London average prices are 2.9 times higher than the north of England, although this is likely to change with the ending of furlough and the stamp duty holiday.

At the present time, the attraction of the Northern cities is currently driven by a greater imbalance between supply and demand than in London.

Factors Outside your Control

Other than affordability, government infrastructure projects will create job opportunities through city regeneration and better transport links in an attempt to level the playing field between the South and the North. This will cause a gradual demographic shift over the next decade. In the short term, however, as a response to the Covid-19 situation, Stamp Duty Land Tax relief has been extended on purchases up to £500,000 to 30th June, with a ‘tapered’ extension, allowing relief on homes up to £250,000 until the end of September 2021, giving a clear buying opportunity now. Property investors in the North will benefit most since more than two-thirds of homes currently listed are for sale at under £250,000 with zero stamp duty.

Manchester – The Best City in the UK to Invest in?

The Northern cities are clearly leading the South in terms of both past capital gains and long-term house price growth and forecasts for the future. However, Manchester stands out as a desirable and affordable city to live in and invest in, with 31% of the population being private renters and some of the lowest vacancy rates of any city. It is recognised as a safer long-term investment in part due to its infrastructure plans, such as the Manchester Metrolink and HS2 rail project, which are creating an efficient, modern transport system around the region.

Birmingham, Edinburgh, Newcastle, Nottingham, Liverpool and Glasgow also all offer significant investment potential, so for the best investment opportunities in these cities, visit our list of investment properties in the UK or contact Lifestyle Property International expert.