How to make money from investing in property

With so many articles and advertisements out there telling you more-less how to make money from property investing, it’s about time to explain in detail how to do so, and what to look out for. This article has been co-authored with Gordon Franks, a mortgage and property investment specialist with over 15 years of experience.

The two main ways of making profits with the property are through the increase in property value and the rental income derived from it. |

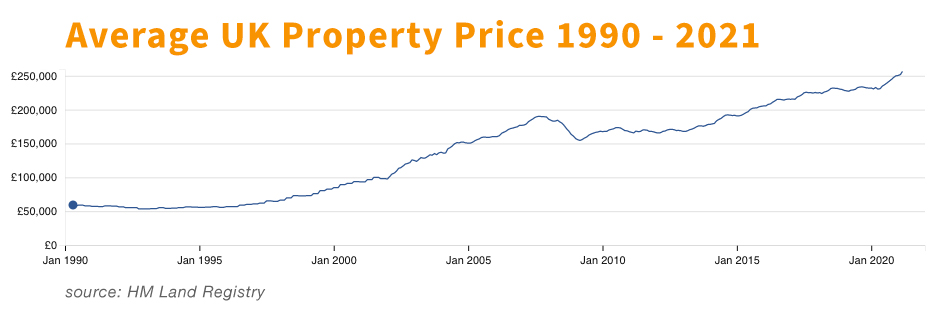

Increasing Property Value

The most common way to make money from property investment is through capital appreciation – an increase in the property’s value by the time you sell it. The increase in value happens due to two main reasons:

1. Inflation

As with most assets and expenses, inflation makes things more expensive overtime, and historically property inflation is higher than the retail price index. As such, the sooner you invest in the property market, the better, as the effects of inflation and supply-demand mismatch will push prices up over time.

Moreover, if you have taken out a mortgage to purchase a property you will realize that the amount you pay for the property may not increase (which is usually a 20 to 30% down payment) although the value of it might. Depending on the type of mortgage you took out, your loan may remain constant or indeed reduce, but the value of your asset should increase overtime.

2. Property’s location becomes more desirable

Property’s location has an enormous impact on its future price growth. In an expanding city, land outside the centre becomes increasingly valuable as developers seek to acquire it. By building residential or commercial buildings, developers increase the value of the location and properties in that area even further.

Moreover, any development or regeneration project will have the potential to increase the property value beyond the inflation mark. Plans for new transportation hubs, train stations, workplaces, green land etc. can exponentially increase the property value in that area. This is simply because the location becomes more in demand, so you, the owner, can increase the price.

Working example:

In 2000 you bought a property for GBP 150,000, but you only had to put a 20% down payment for it – a GBP 30,000. The rest of the property purchase price was secured by a mortgage.

20 years later, in 2020, your property price increased to GBP 300,000 – an increase of GBP 150,000 or double. Assuming you had a repayment mortgage and paid off your mortgage with the rental income derived from the property, you now own a property worth GBP 300,000 for which, actually – you “only” paid/invested GBP 30,00 (+ fees and taxes).

Should you want to sell it at that time – you would have made a gain of 3000,000 – 30,000 = GBP 270,000.

Please note that in this example, we omit all the taxes, such as Stamp Duty Land Tax (3-12% of the purchase price) which you must pay when you purchase a property and Capital Gains Tax (28%) – which you pay when you sell it and make a profit from it.

Making money from properties through rental

You can also make money in the form of income derived from renting the property. The rent you can request for your property will depend on the unit size, property location and it can rise with inflation to ensure it is profitable for you.

Related: How to calculate investment property ROI?

The net rental income will be the rent money you receive minus all the expenses you incur as a landlord.

The expenses can include upkeep of the property, refurbishing and maintenance, and a mortgage, if you have one, but also taxes and costs of ownership, such as the ground rent (UK), and of course, the rental income tax. Items such as letting agents’ fees, accountants’ fees, and even buildings and contents insurance are also considered the expenses related to the buy-to-let.

Rental income in the UK

When it comes to rental income rates in the UK, this is something you need to consider and carefully calculate. There are different rates for UK-resident and non-UK-resident landlords, and the rental income tax rates come in certain bands. For example, if you live abroad, you’re classed as a ‘non-resident landlord’ by HM Revenue and Customs (HMRC) – this can lead to an automatic deduction of 20% of your gross rental from the letting agent if you do not complete the relevant form to allow rental to be paid gross.

Therefore, when calculating your potential income from renting a property, you should do a detailed calculation and research of what your costs will actually be. However, in countries such as the UK yields can still be relatively high, or at least sufficient to cover mortgage costs with sensible levels of finance. This way many investors get to benefit from capital appreciation of their property, with the comfort of knowing that any mortgage debt is being repaid through rental.

How to make money from investing in property?

In summary, one can make money from property investments though:

- The increase of the property price overtime

- Inflation – property tends to increase in value faster than inflation

- Collecting rental income

- The right usage of mortgage (a relatively small amount of money can control an asset worth more)

At the end of the day, understanding your goals and risks plays a crucial role in investing and ultimately, making money from properties. Nothing beats professional advice when it comes to dealing with money, and property investing is no different. That’s why if you are considering investing in buy-to-let, it’s worth engaging in the services of property and mortgage consultants, such as the team at Lifestyle!

As an independent broker, we will objectively advise you on the best performing projects we have at hand, all from trusted developers, and we will explain and advise on the best mortgage options to finance your investment property.

Moreover, we can sit down with you and help you with the calculations to see if the given property will meet your expectations and financial goals, be it to maximize the rental income right now or using property to fund the other financial needs you may have, such as retirement or education costs.