What is a Stamp Duty Holiday in the UK?

Initially introduced in July 2020, the Stamp Duty Holiday in the UK and Northern Ireland is a tax saving mechanism aiming to increase house sales in the UK, which dropped down because of Covid-19 and lockdowns. The Stamp Duty Holiday was set to help house buyers during the pandemic by reducing the property tax they have to pay upon purchasing a property or land in the UK. The Stamp Duty Holiday exempts standard stamp duty entirely on properties costing up to GBP 500,000 and is proportionately reduced on houses costing more than GBP 500,000.

What is Stamp Duty Land Tax (SDLT) in the UK?

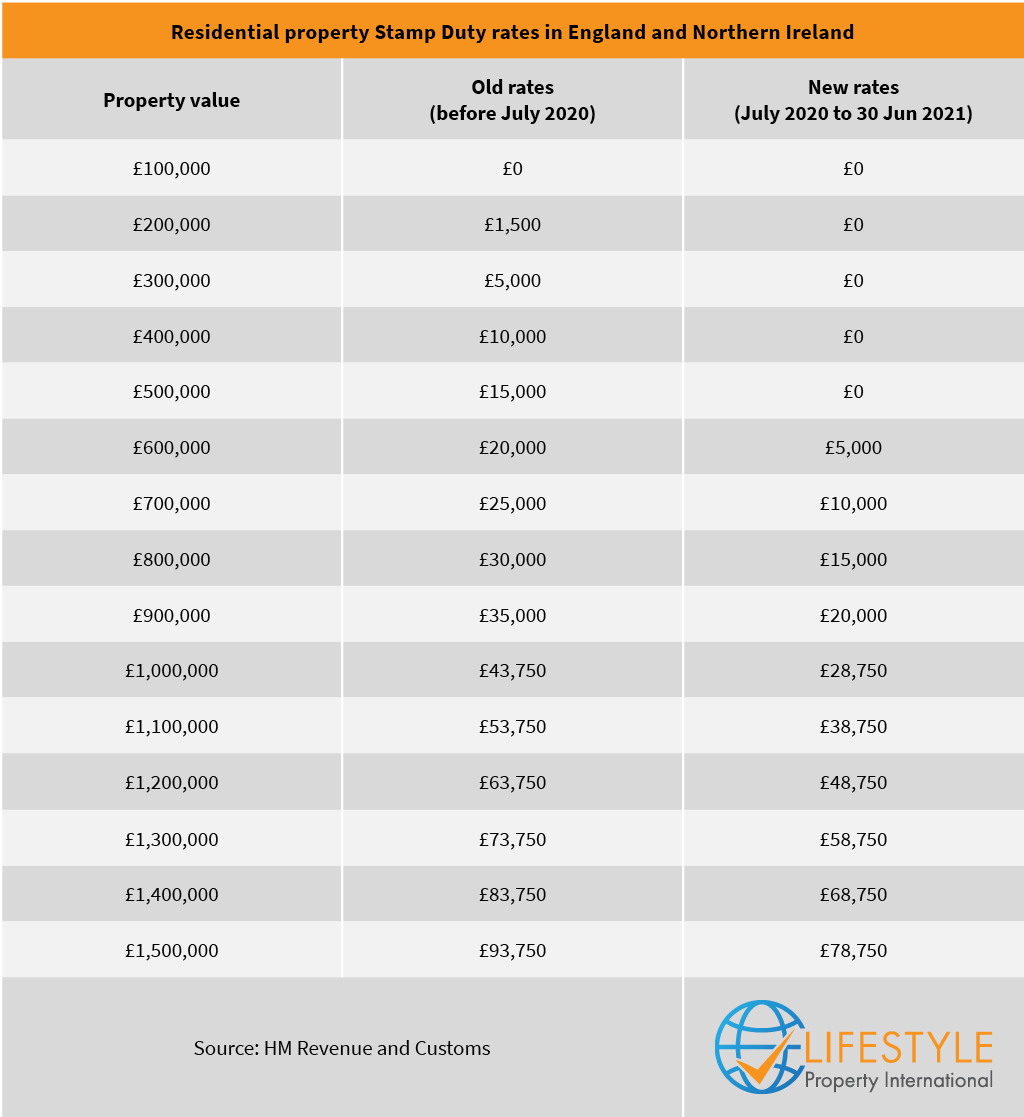

Stamp Duty Land Tax is a form of property tax paid on property or land purchase in England and Northern Ireland. Before the Stamp Duty Holiday, the tax had to be paid on any property costing more than GBP 125,000. If you were a first-time homebuyer, you only had to pay Stamp Duty Land Tax if your property was over GBP 300,000.

Stamp Duty Holiday tax reductions

Stamp Duty Holiday brought tax reliefs for homebuyers. Now, if you purchase a property as your main home before June 30th 2021, and don’t own any other properties. you don’t pay stamp duty if your property costs less than GBP 500,000.

If your property costs more than GBP 500,001 but less than GBP 952,000, you will be taxed 5% of the remaining property price. If your property costs more than GBP 925,001 to GBP 1, 500 000, then this portion will be taxed at 10%. If the property you want to buy costs over 1,500,001, then the remaining amount will be taxed at 12%. The Stamp Duty Holiday equates to GBP 15,000 savings on the property tax.

Residential property Stamp Duty rates in England and Northern Ireland

Stamp duty changes: Stamp Duty Holiday extended until the end of June 2021, with a transition phase ending in September.

The Stamp Duty Holiday was initially set to end on 31st March 2021. However, Chancellor Rishi Sunak announced in his Budget that the tax break would be extended until end of June 2021. From July until end of September 2021, the nil rate band will be set at GBP 250,000 – double its standard level of GBP 125,000 and return to that level on October 1st, 2021.

A New 2% surcharge on SDLT transactions undertaken by non-UK residents comes into effect from 1 April 2021.

In addition to the above, all non-UK residents buyers of residential property in England and Northern Ireland will be surcharged an additional 2% on top of all the existing Stamp Duty Tax rates. This rule comes as the Government’s effort to control house price inflation in the UK and to encourage UK residents to buy houses and increase UK-resident’s homeownership.

What does it mean for UK property investors?

The Stamp Duty Holiday extension is good news for those who are considering investing in UK property in 2021. Especially for those who are looking to buy-to-let or first-time investors with a budget less than GBP 500,000, the savings can be a welcome push to complete the transaction before the deadline. House prices in the UK are steadily growing and with normally high Stamp Duty tax rates, the Holiday can save up to GBP 15,00, or sometimes even more, as you might be qualified for an SDLT Refund.

Lifestyle Property International specialises in buy-to-let investment properties in the UK, with units starting from as little as GBP 99,000 in Birmingham Commuter Development, or from GBP 297,500 for those interested in buying a property in London. Both of these investment properties are within the range qualifying for the Stamp Duty Holiday savings.

For more information about our investment developments, as well as property financing options, yields predictions and more, please contact Lifestyle Property directly.