Get Ahead of the Birmingham Growth Story

Are you looking to invest in the UK property market? If so, Birmingham’s property market is the place to be! Birmingham is undergoing a large-scale regeneration project, named the Big City Plan and with HS2 soon connecting Birmingham with London in under 50 minutes, the city is on the rise. Investing in Birmingham property today could see you reap the rewards of soaring property prices tomorrow. Read on to find out more about why Birmingham should be your next property investment.

Birmingham Property Market 2023

Birmingham has long been overlooked as a worthwhile investment destination in comparison to London and Manchester – but the time to seek opportunities there is now. The UK’s second largest city boasts all the fundamentals necessary for savvy investors to make impressive returns over their desired timeframe.

Birmingham’s property market is currently thriving, with house prices increasing by 6.3% annually according to HM Land Registry data. This is faster than the UK average of 4.5%. It has seen a surge in young professionals and first-time buyers attracted by the city’s booming economy, making it an ideal place for property investors to capitalise.

Birmingham Key Facts

- UK’s Second city

- 1.3 million population

- 40% of the population is under 25

- Top 3 UK destination for Foreign Direct Investment

- 3 major universities 75,000 students

- HS2 will reduce travel time to London – under 50 minutes

- Direct access to over 100 destinations globally

- Big City Masterplan regeneration worth £1.9 billion

- Tourism - £7.1 billion

- Estimated house growth 19.2% (2023 – 2027)

- Average rental yield 5.1%

Why are property prices rising so fast in Birmingham?

The cost of living in Birmingham is approximately 60% lower than in London, leading to corporates, such as HSBC, Goldman Sachs and Deutsche Bank recognising that value and relocating teams to Birmingham. The property market is growing at an exponential rate, fuelled by the influx of young professionals following their jobs, and the growing deficit of housing supply.

The increase of people looking for new job opportunities and companies moving staff creates a particularly rewarding opportunity for Buy-to-Let investors. Demand for rental is greater than the limited supply of city centre accommodation. This is pushing rental yields up and ultimately capital values, too.

Growing City

Around 40% of Birmingham’s population is aged under 25, and a total of 64.25% are working age (16-64). This is a key age group of tenants in the private rented sector, with young professionals one of the most likely age groups to rent.

The city needs around 4,000 homes per year over the next 10 years to meet the increasing demand. This means that there is plenty of opportunity for investors to make good returns in this market.

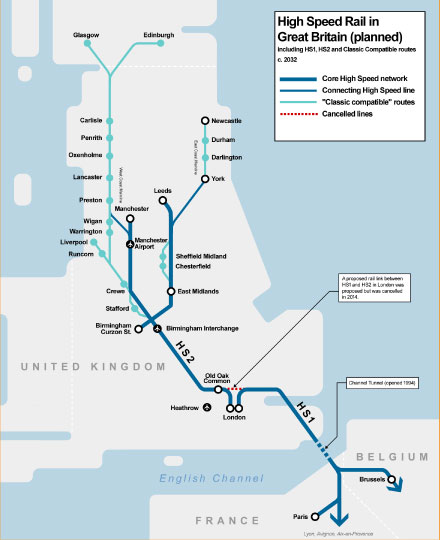

Benefits of HS2 Speed Rail

Birmingham’s new high-speed rail link with London has the potential to create huge economic growth in Birmingham and its surrounding areas. When launched (2029 – 2031) Birmingham will be just 50 minutes away from the UK capital, making it the ideal commuter destination for those wishing to work in London but live outside of the city.

The HS2 link will increase Birmingham’s appeal as an investment destination where you can expect a property that can yield both capital appreciation and rental income.

The Power of Regeneration

Higher capital appreciation compared to local average

Higher rents compared to local average

Newer and comprehensive communal facilities, such as gymnasium, swimming pool, rooftop gardens, etc.

Smithfield, Birmingham

- £1.9bn investment

- 300,000 sqm of multi-purpose space

- 2,000 new homes

- £60bn New Street Station redevelopment nearby

- Last phase scheduled to complete in 2034

Birmingham Regeneration Projects

Birmingham is currently undergoing a major regeneration project known as the Birmingham Big City Plan. This project will transform Birmingham, and especially an area close to the city centre – into one of the most vibrant cities in Europe and has already had an impact on property prices. Birmingham’s masterplan includes the development of new residential and commercial properties, public spaces, leisure facilities and transport links that are expected to increase Birmingham’s population by 30%.

Investing in Birmingham in 2023

Birmingham’s booming economy and large-scale regeneration projects make it an attractive destination for property investors. With rental yields of 5.11% far exceeding those of London’s 2.9%, and property prices still relatively affordable, savvy investors are taking advantage of unprecedented levels of inward investment and rental demand.

To explore further, contact us now.

Investing in Birmingham in 2023

Birmingham’s booming economy and large-scale regeneration projects make it an attractive destination for property investors. With rental yields of 5.11% far exceeding those of London’s 2.9%, and property prices still relatively affordable, savvy investors are taking advantage of unprecedented levels of inward investment and rental demand.